When importing products you need to be aware that almost all countries subject goods to some form of taxes and fees in order for the goods to enter the country. The fees vary by product and country and can be quite difficult to understand.

The simple way is to simply know your products HTS (harmonized Tariff schedule) code and then look it up on your respective countries’ trade agency website. In the United States that is the Customs and Border Control, Canada

Importing to the United States: Customs Duties

In essence, the process is fairly simple:

- Figure out the HTS code of your product

- Figure out the total cost of your shipment

- I.e. if you are shipping 1000 units at a value of $5 each, then the total shipment is $5,000

- Figure out the tax rate for your HTS code

- Total shipment * Tax rate = Payments made to customs

We’ll go over each step in full detail later on in this guide

Tariffs Importing from China to the United States

If you are importing or looking at importing, to the United States you are probably aware that the US has imposed tariffs affecting around $550 Billion worth of goods imported from China. This adds an extra fee that applies to these goods.

Here is a direct link to the list of items affected by the tariffs on China [PDF Warning]

VAT importing into the European Union

While this guide is mainly written for Americans, it’s mostly the same process for the European Union just with different agencies and names. In the European Union, they refer to the as a Value Added Tax (VAT) and the information is published by the Tariff of the European Union (TARIC) which you can visit here: TARIC database

One other important note is that the EU has an additional Combined NOmelcatue (CN) code that is added to the HTS code. This is 2 additional digits at the end that provide extra specific items. Regardless the method of looking up the code is the same.

Please note: This guide is also mostly written from an American perspective, however, the process of finding out tariffs and duties is relatively similar to most Western countries as well as the E.U. Most of the concepts here should be the same.

Do you need to pay taxes and fees for your product?

The first thing you need to do is determine if the product can qualify for informal entry. Informal entry is for small value items typically less than $2500 and can be classified for personal use. There are some exceptions, like textiles, shoes and several other items where the limit is $250. We’ll discuss the exceptions for textiles and other products later on.

Informal Entry vs Formal Entry

When a product enters the port and is going to be cleared by customs you need to figure out if it will be classified as a formal or informal entry. The easiest way to do this is simply figuring out the value of the total shipping. If it’s more than $2500 it will need to be classified as Formal entry and is subject to all relevant taxes and fees. If it is less than $2500 then it should be able to enter without having to pay any duties, however, there are exceptions.

What is Informal Entry?

Informal entry covers for Commercial shipments, mail shipments, and personal shipments that are less than $2500. If the total declared value is less than $2500 and not restricted class customs will “Liquidate” the items and clear it almost immediately. IN addition to being much cheaper, it’s much faster, getting cleared hours after entry instead of days, and involves almost no paperwork.

IF you are Importing Goods that are permitted as informal, you do not need to post or purchase a Customs bond. The customs agent who is inspecting the goods may choose to inspect the goods and verify them, but from experience this rarely if ever happened. In most cases, an inspector and not a customs agent will determine the classification and make the final judgment call if an informal entry will be permitted. The inspector will also be reviewing the documents relating to the shipment. You will still need to submit some paperwork, most notably a packing list and Commercial invoice and present them to customs.

What is a Formal Entry?

The formal entry is broadly any entry for commercial or business purposes, however, it does include any shipment whose total value is more than $2500. This includes shipment for personal or other use. In order to import goods that are Formal Entry into the United States, you will need to purchase a Customs Bond in advance.

Customs Bonds act similar to an Insurance policy and it payable to Customs and Border Protection, in case you, the imported does not comply with the import requirements. Another benefit of the Bond is that the Importer can take possession of the goods before the payment of duties. Almost all freight forwarders should have the ability to let an imported purchase the bonds at the same time you book and pay for a shipment. We cover customs bond in more depth in this article: 7 Shipping Documents Required for International trade made Easy // Complete Guide

Exception for importing Textiles, shoes, and more

There are a few exceptions to what can be declared as informal. Textiles, (Clothing and Apparel) shoes and restricted items, have a much lower volume of just $250. IF you are importing CLothing or shoes valued more than $250 you will need to declare a formal entry and the goods will be subject to taxes.

How to Figure out the HTS Code for your product

One of the big things that you need to know about your product is the HTS Code. HTS stands for Harmonized Tariff Schedule and the system in which the US determines what tariffs are placed on a product. Any product imported into the US needs to be accurately classified by its HTS code and the tariffs will be applied accordingly. The HTS code is based on the International Harmonized System, which is a globally recognized system of trade classification.

This part can be difficult, especially if it’s a new product it takes a decent amount of searching to find just the right product category. If you’re importing an existing product, then they should have a classification. But if you are importing a new product that does not exist in the market it can the easiest way to do it is to look for similar items or items made of the same material.

You can freely search the US’s database here: https://hts.usitc.gov/

In the end, you should have a 10 digit HTS number (####.##.####) that corresponds to your product. Now that you have that figured out you can look up the tariffs.

How to Lookup the Tariffs of your product

This is for importing into the United States, however, almost every other country publicly posts the rates on a publically available government website. For the most part, the rates will be done by the department or ministry that handles trade. You can use the same HTS tool to lookup your tariffs as you did to look up the HTS code: https://hts.usitc.gov/

If you are importing from China into the United States, you can view the full list of affect products and their tariffs here [PDF Warning]: https://ustr.gov/sites/default/files/2018-13248.pdf

Looking to avoid the tariffs on Chinese goods? Sourcing from Vietnam is one of your best options. Cosmo Sourcing has been helping clients find suppliers in Vietnam since 2013 and is one of the only sourcing companies that can source from both Vietnam and China. If you’re interested, check out our Vietnam Sourcing page or reach out directly to us at info@cosmosourcing.com

Existing tariffs and Duty Taxes

Keep in mind that in addition to the new tariffs there are still existing duties and fees that are applicable to most products. By using the same link to the HTS database you should be able to find the existing duties. This database has the duty listed,

Here is a direct link to the CHina Tariffs list [PDF warning]

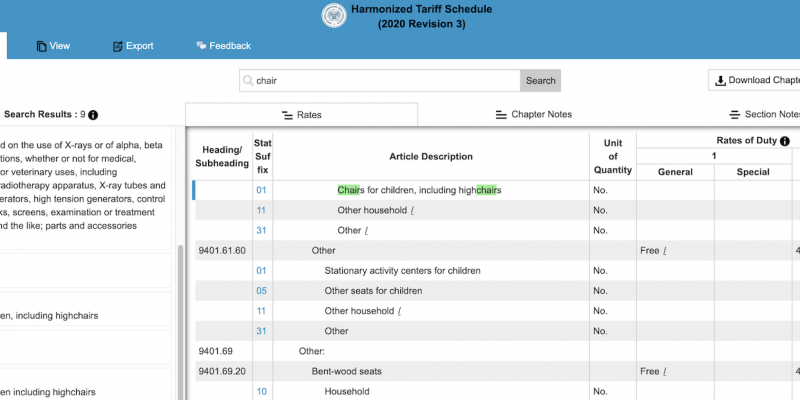

IN the above you’ll notice multiple columns, From left to right they are

- Heading/Subheading, which is the HTS Number (4, 6, and 8 digits) Stat Suffix, which combined with the Heading/Subheading is the 10 digit HTS Number

- Article description

- Unit of Quantity

- Tariff Rates

- General Rate of Duty

- Special Rate of Duty

- Column 2 Rate of Duty

This is just a quick summary, the full in-depth guide can be found here [PDF Warning] http://www.usitc.gov/documents/hts_external_guide.pdf

Potential Regulatory issues when Importing

Looking up regulatory issues tends to be the hardest aspect of the validation step. There isn’t really a centralized database, for what regulations are needed for each product.

The Best resource in the US is from the Customs and Borders Protection (CBP), which publishes a number of guides across a huge range of products and classifications. Not sure if what your importing is a bolt or a screw? They have a guide for that. Are you imported mittens, figure out how they are made because if they are crocheted or knitted than surprise! You’re getting tariffs! You’re going to want to sit down for this one. Ready? Check out this groundbreaking decision on The difference between candle holders and decorative glass!

To add further complications, agencies such as the FDA and FCC regulate the import of goods but defer the enforcement to CBP. if you are importing anything relating to health or food, it’s most likely that it is subject to FDA approval or regulations.

If you import an electronic item, particularly one that has radio waves, including but not limited to cellular, wifi or Bluetooth, that you need to get FCC approval. IF you are importing natural food items it is regulated by the Department of Agriculture, but it also may be subject to the FDA as well. There are more agencies that have their own regulation but the FCC and FDA are the two that we encounter the most. Ultimately it’s up to you to research and find out the regulations.

The CBP is the agency that is in charge of clearing goods for export, so they are the final authority on this issue. If you are really unsure, you can message the CBP and request a letter to classify or clarify the goods. However, at the time of this writing, the Government and CBP are shut down and not responding to any request. Even when the agency is open, there is no guarantee that they will respond and if they do the response can take weeks. At the end of the day, we recommend you do the research yourself.

You can go to the Customs and Border Protection’s website and see the full list of guides. https://www.cbp.gov/trade/rulings/informed-compliance-publications

Final Thoughts

The fees and taxes that you pay always seems to be one of the biggest question marks imported have when they are importing goods into the country. Too many people just don’t do their research and just hope for the best when the goods pass through customs. IF you know what you are doing and do your research ahead of time you shouldn’t be worried, because you know exactly what to expect and can plan and budget accordingly.